Much has changed in the oil and gas industry over the past two years, but the Eagle Ford Shale Play still holds great value for investors and operators.

Related: Billions of Barrels Available in the Eagle Ford

Industry leaders gathered in San Antonio last week for the Hart Energy DUG Eagle Ford conference and exhibition, where conversation and presentations centered around the status of the Eagle Ford Shale outside of the boom.

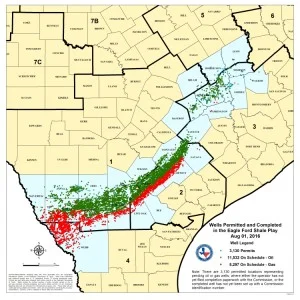

Activity in the Eagle Ford has slowed to its lowest point since 2010 with the Texas Railroad Commission (RRC) reporting last week that they issued 4,830 original drilling permits throughout the state of Texas from January-August. 642 of those permits are for operations in the Eagle Ford Shale. If the trend continues, the Eagle Ford will have fewer permits issued by the end of the year since before 2010.

Despite the massive shift since the glory days of the play, the Eagle Ford is still a prized space in the industry with many productive years ahead. Researchers from the UT’s Bureau of Economic Geology say that the 400-mile field has seen just a fraction of its ultimate activity and their new study predicts that another 100,000 wells can still be drilled.

“The strategic value of the Eagle Ford stands the test of time, so even in the down cycle the values are still very strong.”

Richard Mason from Hart Energy summarized the key takeaways from the conference, with substantial technical progress topping the list. Eagle Ford operators are reducing costs and cycle time and improving recoveries. Operators are drilling longer laterals more quickly or doing the work of six rigs previously, only at lower costs. He also highlighted the huge potential available in Mexico and encouraged everyone to think of North America as an ‘integrated energy province’.