Matador Resources Compnay

Matador Resources Company is an independent energy company engaged in the exploration, development, production and acquisition of oil and natural gas resources in the United States, with an emphasis on oil and natural gas shale and other unconventional plays. Current operations are focused primarily on the oil and liquids-rich portion of the Wolfcamp and Bone Spring plays in the Permian Basin in Southeast New Mexico and West Texas and the Eagle Ford shale play in South Texas.

Eagle Ford Shale Oil & Gas Discussion Forum

Join the Eagle Ford Discussion Group today - your voice counts!

MineralRightsForum.com is a discussion network for mineral owners, royalty owners and industry professionals to discuss oil & gas related topics.

Counties Where Matador Resources is Active

Matador Resources Eagle Ford Shale Quarterly Commentary

Press Release

February 2016

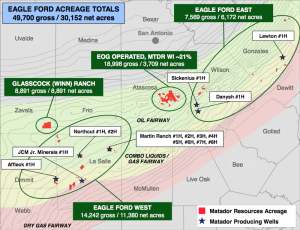

Matador completed and began producing oil and natural gas from 18 gross (17.3 net) wells in the Eagle Ford shale in 2015, all in the early portion of the year, including 17 gross (17.0 net) operated wells and one gross (0.3 net) non-operated well. During the second quarter of 2015, Matador concluded its planned drilling and completion operations for 2015 and did not drill or complete any additional operated wells in the Eagle Ford shale for the remainder of 2015.

Matador does not plan to drill or complete any operated wells in the Eagle Ford shale during 2016. AtDecember 31, 2015, approximately 90% of the Company's acreage in the Eagle Ford shale was either held by production or not subject to expirations before 2017. Matador has allocated approximately $5.6 million(less than 2%) of its 2016 estimated capital expenditures to the Eagle Ford shale to allow for the installation of pumping units on certain properties and for lease extensions and acquisitions, as and if desired.

December 2o15

For year's end, Matador announces production rates for Eagle Ford operations at 85.1 million BOE 45.6 million Bbl oil (54% oil). They also forecast no Eagle Ford drilling activity in 2016

August 2015

Matador Resources released 2015 second quarter results that were “full of milestones’. In an earnings call the company announced that even in the midst of low crude prices, the company was able to achieve record production while reducing costs and obtaining a 30% to 50% rates of return on drilling in the Eagle Ford.

Second quarter production for Matador’s Eagle Ford operations increased to its all-time high of 11,942 BOE per day, consisting of 9,358 barrels of oil per day and 15.5 million cubic feet of natural gas per day. Foran attributed the increase to the initial performance of eight wells in Karnes County, Texas that were put into production late in the first quarter.

Matador completed and began producing oil and natural gas from four Eagle Ford wells during the second quarter. The company says it has now completed its planned operated Eagle Ford drilling and completion operations for 2015.

May 2015

In an earnings call on May 7th, Matador executives discussed the company’s $50.2 million loss for the first quarter of 2015, a drastic change from the $16.4 million profit reported one year ago. Low oil prices have taken a toll on the company’s earnings and caused them to temporarily suspend operations in the Eagle Ford Shale. Responding to questions about Matador’s intentions for the Eagle Ford, Joe Foran – CEO responded that “we are looking, hopefully that circumstances will suggest to be acting again in the Eagle Ford in 2016. We are very open to acquiring and are in the process of acquiring some additional acreage there (EFS) to build up our inventory. We feel we’ve got 250 or so wells to drill over there with welcome deals if some people have expiring acreage that they would like for us to be interested in. We’ve got a lot of good locations left there and we are really high on the Eagle Ford still.”

January 2015

Matador Resources Company announced plans to reduce its operation by cutting production from two rigs in Eagle Ford in 2015. This is a big move for the company considering that their oil, natural gas and total oil production were at record levels at the end of 2014. Management says that their strategy to narrow drilling efforts to three rigs in its Permian Basin operations is necessary in light of lower oil prices, which have dropped from $100 per barrel in June to below $50. But the company insists that it isn’t abandoning the region entirely. The report states, “As a result of the Company’s strong execution in the Eagle Ford over the past three years, this asset has become an “oil bank” that Matador can return to and develop further at a future time when commodity prices are more favorable.”

August 2014

The company recorded a 30% quarter-on-quarter production increase to 15,424 boe/d, and a 46% increase year-over-year.

During the quarter, approximately 54% of the company’s natural gas production was liquids-rich natural gas, primarily from the Eagle Ford Shale. That’s a jump compared to the year ago quarter when Matador’s liquids-rich natural gas cut for its natural gas production was around 33%.

Matador had two drilling rigs operating in South Texas during the second quarter of 2014. During the quarter, the company completed and began producing from nine gross (6.2 net) Eagle Ford wells, including six gross (5.4 net) operated and three gross (0.8 net) non-operated Eagle Ford wells. Matador completed three operated Eagle Ford wells on its Northcut lease and two wells on its Martin Ranch lease in La Salle County and one well on its Lyssy lease in southern Wilson County. The three non-operated wells were completed on its Troutt lease in La Salle County.

As of August 6, 2014, Matador had two drilling rigs operating in the Eagle Ford. One of the rigs is on the company’s Lyssy lease in southernWilson County and one is on its Pawelek lease in Karnes County.

April 2012

About 8% of our daily production, or 3.3 MMcfe per day, including 331 Bbls of oil per day and 1.3 MMcf of natural gas per day, was produced from the Eagle Ford shale in south Texas for the year ended December 31, 2011. The Eagle Ford contributed approximately 78% of our daily oil production and about 3% of our daily natural gas production for 2011. For the month of December 2011, about 13% of our daily production, or 5.6 MMcfe per day, including 706 Bbls of oil per day and 1.3 MMcf per day, was produced from the Eagle Ford. During December 2011, the Eagle Ford contributed 91% of our daily oil production and about 4% of our daily natural gas production. At December 31, 2011, approximately 14% of our proved reserves, or 27.9 Bcfe, was attributable to the Eagle Ford, including approximately 3.6 million Bbls of oil and 6.1 Bcf of natural gas. Our Eagle Ford proved reserves at December 31, 2011 comprised approximately 96% of our proved oil reserves and approximately 4% of our proved natural gas reserves. The present value discounted at 10% for our proved reserves in the Eagle Ford at December 31, 2011 was $130.2 million, or about 52% of the PV-10 for our total proved reserves of $248.7 million. We anticipate that the percentage of our daily production and reserves attributable to the Eagle Ford shale will grow in 2012 as we intend to allocate approximately 84% of our 2012 capital expenditure budget to the exploration, development and acquisition of additional interests in the Eagle Ford play in an effort to grow the oil and liquids component of our production and reserves.